Washington, D.C. – April 21, 2025 : President Donald Trump has intensified his public criticism of Federal Reserve Chair Jerome Powell, urging immediate interest rate cuts to stave off what he describes as a looming economic slowdown. The remarks, made via Trump’s Truth Social platform, have sent shockwaves through financial markets, raising questions about the independence of the Federal Reserve and the broader implications for U.S. monetary policy.

Trump’s Criticism and Economic Context

In his latest post, Trump labeled Powell a “major loser” and accused him of acting too slowly on monetary policy. Trump argued that with inflation cooling highlighting falling energy costs and food prices there is no justification for maintaining current interest rates. “There can almost be no inflation, but there can be a SLOWING of the economy unless Mr. Too Late lowers interest rates, NOW,” Trump wrote.

The President’s comments come amid a backdrop of easing inflation, which has dropped from a peak of 9.1% in 2022 to 2.4% as of March 2025. Despite this, Powell and the Federal Reserve have maintained a cautious stance, keeping rates steady to monitor economic uncertainties, including the impact of Trump’s aggressive tariff policies.

Market Reaction

Trump’s remarks have rattled Wall Street, with major U.S. stock indexes experiencing significant declines. On Monday, the Dow Jones Industrial Average fell by 449.67 points (1.15%), the S&P 500 dropped 63.52 points (1.20%), and the Nasdaq Composite lost 226.68 points (1.39%). Analysts attribute the market volatility to growing concerns over the Federal Reserve’s independence and the potential for political interference in monetary policy.

The dollar also took a hit, reaching its lowest point in three years against a basket of currencies. Economists warn that undermining the Fed’s autonomy could erode investor confidence and destabilize financial markets.

The Debate Over Fed Independence

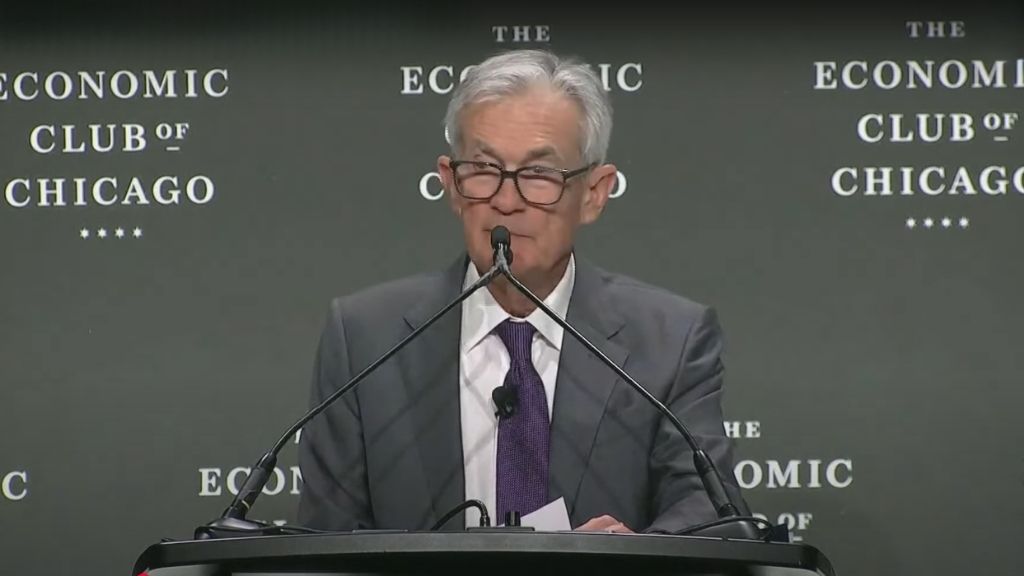

Trump’s public attacks on Powell have reignited debates about the Federal Reserve’s independence, a cornerstone of U.S. financial policy. While the President has expressed frustration with Powell’s cautious approach, legal experts emphasize that the Fed Chair cannot be removed without cause. Powell, whose term ends in May 2026, has reiterated his commitment to making decisions based solely on economic data, free from political pressure.

White House economic adviser Kevin Hassett has acknowledged that the administration is exploring legal avenues to remove Powell, though such a move would likely face significant legal and political challenges.

Global Implications

The standoff between Trump and Powell has far-reaching implications, not just for U.S. monetary policy but also for global markets. With trade tensions between the U.S. and China escalating, the uncertainty surrounding interest rates adds another layer of complexity for investors. Energy stocks have been particularly affected, with Tesla shares plunging 5.2% and Nvidia dropping 3.9% amid broader market jitters.

Looking Ahead

As Trump continues to pressure Powell for immediate rate cuts, the Federal Reserve faces a critical test of its independence and credibility. The coming weeks will be pivotal in determining whether the central bank can navigate these challenges while maintaining its focus on long-term economic stability.

I’m an independent writer covering global news with a focus on U.S.-related topics.